Egypt's stocks shrugged off political tensions resulting from the storming of the US Embassy in Cairo Tuesday, seeing mild gains in Wednesday's trading session.

The main EGX30 benchmark gained 0.49 per cent to close at 5,726 points, its highest level since the popular uprising that unseated former president Hosni Mubarak in 2011.

Trading activity saw yet another boost, recording LE1 billion in turnover ($163 million), a level unseen since January 2011.

At the beginning of the session, the EGX30 surged as high as 80 points, while an hour into the session it started to gradually drop to its closing level.

"Traders started off the session with high optimism, but this faded as time went by," Walaa Hazem told Ahram Online. "The full effect of yesterday's events are yet to be seen."

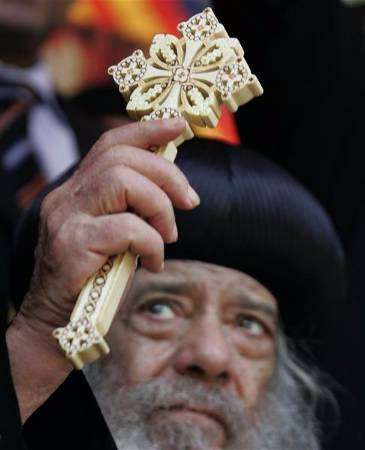

Angry protestors broke into the US Embassy compound in downtown Cairo protesting an allegedly offensive anti-Islam film produced in California. Further West, the US ambassador in Libya, along with several other embassy officials, was killed in angry attacks on the US consulate in Benghazi.

The stock market, for its part, seemed oblivious to the development. Some say that the market simply had strong momentum that enabled it to take the hit inconspicuously.

“The stock market’s performance has been surging for a long time and the events related to the anti-Islam film have been ongoing for almost a week now," Mostafa Badra, capital market expert, explained.

The Commercial International Bank (CIB) led the market surge today, gaining a strong 2.19 per cent and marking LE76 million of turnover.

Investment bank EFG-Hermes shares, which have seen superb growth over the past few weeks, were the most active today at LE143 million turnover, but dropped 1.43 per cent to close at LE13.11 per share.

Investors, however, should be careful in analysing the market's growth, experts say.

“I expect the market’s main index to drop significantly in the coming period," Badr predicted, without putting a timeframe for his forecast. "Investors are not looking at the actual state of the fundamentals of the Egyptian economy, which are not very positive at this moment."

Badr referred to the surge in the state budget deficit and a depreciation of the Egyptian pound as indicators of the weak state of Egypt's public finances.

Non-Arab foreign investors were net buyers in Wednesday's session, albeit at a slim LE4.2 million. They made up 20 per cent of the session's volume.

Egyptian investors contributed 73 per cent of the session's volume, net-selling at LE6 million.

Out of 183 shares traded, 77 gained value while 94 dropped. The broader-based EGX70 index saw a mild 0.28 per cent drop.