The Central Bank of Egypt (CBE) reduced the share of foreign-currency reserves it held in euros late last year, a person familiar with the matter said Sunday.

The Cairo-based bank started to divest part of its holdings in euros around November, the person said on condition of anonymity because the decision wasn't made public.

Egypt's net international reserves have been rising since May 2009, reaching $34.7 billion in April, according to the central bank's website.

The euro, which has slumped 16 per cent this year, dropped below $1.20 for the first time since March 2006 last week after Greece tapped a 750 billion-euro ($913 billion) emergency-loan package put together by the European Union (EU) and the International Monetary Fund (IMF).

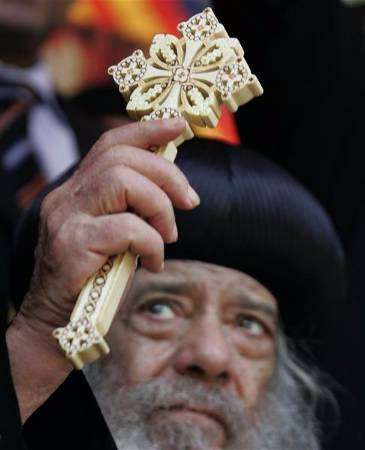

Governor Farouk Al-Oqda said the Egyptian central bank had foreseen the debt crisis in Europe, allowing it to hedge against the risk by managing its currency reserves, the state-run Al-Ahram newspaper reported.

"While Europe remains Egypt's largest trading partner, the US dollar remains the dominant foreign currency in Egypt's international reserves," Mohamed Abu Basha, an economist at investment bank EFG-Hermes Holding SAE said in a note Sunday.

"We estimate that the euro's contribution to total reserves stands at 20 percent, which may have declined."

Deputy Central Bank Governor Hisham Ramez declined to comment when contacted by Bloomberg News today. "We don't talk about the way the central bank manages its reserves," he said.

The independent Al Masry Al-Youm newspaper had reported the central bank's decision to divest portions of its reserves in euros over the past six months today, citing an unidentified person close to the institution.

The euro shed 13.8 per cent against the Egyptian currency this year, according to Bloomberg data. The pound lost 3 per cent against the US dollar in the same period.