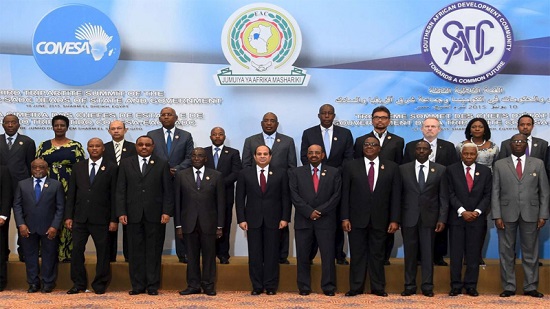

A year has passed since the heads of states and government of Africa's three economic blocs — COMESA, SADC and the East African Community (EAC) — met in Sharm El-Sheikh on 10 June 2015 to sign and launch the largest continental alliance through a free trade agreement (FTA) between the three blocs.

Implementing Africa's largest free trade agreement

By-Sherif Fahmy- Ahramonline

Opinion

00:07

Tuesday ,05 July 2016

The journey to this glory started in the First Tripartite Summit on 22 October 2008 and a Memorandum of Understanding on Inter-regional Cooperation and Integration amongst COMESA, EAC and SADC that was signed between the CEOs of the three blocs.

Further to that, the Second Tripartite Summit on 12 June 2011 launched negotiations for the establishment of the Tripartite Free Trade Area (TFTA).

After four years of tough negotiations the agreement was finally signed by 16 member states in Sharm El-Sheikh, Egypt.

The signing of the agreement in Egypt emphasised the pivotal role that Egypt plays in the African continent and proved the keenness of Egypt to have an important say on the regional integration agenda.

The tripartite initiative by COMESA-SADC-EAC emerged to contribute to the accomplishment of a larger vision of establishing an African Economic Community as outlined in the 1980 Lagos Plan of Action and the Abuja Treaty of 1991. The idea was to resolve the issue of overlapping memberships of countries in more than one economic bloc.

Accordingly, the heads of states and governments held two tripartite summits in Kampala in 2008 and in Johannesburg in 2011. The first tripartite summit held in Kampala approved the expeditious establishment of an FTA encompassing the member/partner states of the three regional economic communities (RECs) and accentuated the fact that the tripartite arrangement is a crucial building bloc towards achieving the African Economic Community.

The second tripartite summit held in Johannesburg witnessed the signing of the declaration to launch negotiations for the establishment of the tripartite free trade area, the adoption of the roadmap for establishing the FTA, and the negotiating principles, processes and institutional framework.

The heads of states and government endorsed three pillars of integration: 1) market integration; 2) industrial development; and 3) infrastructure development.

The first phase of the tripartite negotiations covered the market integration pillar while the movement of business persons was considered a parallel and separate track.

The second phase will cover trade in services, intellectual property rights, competition policy, and trade development and competitiveness.

The tripartite member/partner states are comprised of 26 countries; Angola, Botswana, Burundi, Comoros, Djibouti, DR Congo, Egypt, Eritrea, Ethiopia, Kenya, Lesotho, Libya, Madagascar, Malawi, Mauritius, Mozambique, Namibia, Rwanda, Seychelles, South Africa, Sudan, Swaziland, Tanzania, Uganda, Zambia, and Zimbabwe.

Despite the signature of the main text by 16 member states (no ratifications yet), there are many important annexes that are still outstanding, which are considered key instruments to the full effective implementation of the agreement.

A post-negotiations key factor of the tripartite FTA is the timely implementation of the agreement. The effective implementation of tripartite FTA commitments by member/partner states is therefore a priority that calls for an objective assessment with a view to identifying and defining the scope and range of issues that deserve member/partner states attention and consequent action.

The second meeting of the Tripartite Sectoral Ministerial Committee on Trade, Finance, Customs, Economic Matters and Home Internal Affairs directed the TTF to prepare a draft post-Signature implementation roadmap, which will be adopted at the signing of the TFTA agreement.

The tripartite TFTA post-signature implementation roadmap is a framework that identifies priority areas, the necessary actions, including sequencing, and the responsible actors. It complements the TFTA roadmap adopted by the second summit of the tripartite heads of states and government in June, 2011.

Elements of the post-signature implementation roadmap

The key focal areas of the TFTA post-signature implementation roadmap consist of the following:

— Notification of the World Trade Organisation

— Finalisation of negotiations on outstanding areas of the TFTA agreement (market access, rules of origin, etc)

— Designation and notification of TFTA focal points

— Ratification of the TFTA agreement

— Creating a depository for the instruments of ratification

— Commencement of implementation of the TFTA agreement

— Public awareness

— Capacity building

— Preparation of a TFTA Resource Mobilisation Strategy

Significance of the Agreement

A single FTA covering a large market of 26 countries, which constitutes half of the member states of the African Union.

Exemption from customs duties

- Creation of a more conducive environment for foreign direct investment (FDI attraction)

- Elimination of non-tariff barriers

Socioeconomic indicators of the tripartite agreement

- Tripartite contribution in Africa GDP: 58 percent

- Tripartite GDP: $624 billion

- GDP per capita: $1,184 per annum

- Tripartite population: 625 million people

- Tripartite population to African Union population: 57 percent

The agreement was signed but it will take more negotiation rounds to finalise the outstanding issues, in order for it to enter into force. No tangible progress has been achieved since the signing, as technical level negotiations are still ongoing. The market access and tariff liberalisation offer has only been exchanged bilaterally between Egypt and EAC while SACU member states have made no key progress worthy of mention yet. This means that the timeframe will be extended for at least two more years.

The risk is that the African Union launched negotiations on a continental FTA (CFTA) and according to the AU roadmap the CFTA should be launched in 2017. Consequently, the tripartite FTA has to be finalised before that date.

Egyptian negotiators should push aggressively to finalise negotiations on rules of origin and market access. This will give Egyptian products the privilege of penetrating the tripartite non-COMESA member states' markets with a competitive advantage.